How to Choose the Right Invoice Reconciliation Software for Maximum Procurement Efficiency

Reconciliation sounds simple. Match the invoice, approve the payment, done. But in real procurement environments, it’s never that clean. You’ve got shipment delays, partial deliveries, rate mismatches, missing documents, and a hundred moving parts between PO and payment. That’s why invoice reconciliation tends to quietly eat up way more time and attention than it should.

What actually solves this isn’t another generic tool. It’s using invoice reconciliation software that’s built to handle the mess, like automating the matching, plugging into your existing stack, and flagging what matters before it becomes a blocker. If you are confused about how to choose the right invoice reconciliation, this guide breaks down everything you need to know to pull the efficiency lever. Let’s start.

Key Features to Look For

Most teams don’t realize how much reconciliation messes with flow. It feels small on the surface, but it piles up: slow approvals, mismatched numbers, annoyed vendors, all of it.

That’s why the kind of invoice reconciliation software you pick has to go beyond just matching numbers. It’s got actually to reduce the noise. Not add to it. These features? Non-negotiable if you’re serious about efficiency.

- Automation Capabilities

Let’s start with the obvious: Manual reconciliation is a black hole. You’re dragging files, copy-pasting stuff, and spot-checking invoices like it’s 2008. It’s not worth the time.

What you need is invoice reconciliation software that does this heavy lifting automatically. For example, it pulls in the PO, GRN, and invoice, checks if they match, and only bothers you if something’s off. Smart systems even learn patterns over time.

So if vendor X always ships two days late or bills with minor deviations, the software knows how to handle it. You just step in when it’s genuinely broken.

- Real-Time Integration

They say they sync with your ERP or TMS, but it’s delayed or clunky. You make a change in one system, and the invoice software is still living in the past. That lag kills accuracy. You want invoice reconciliation software that updates instantly. Real-time stuff.

So if someone updates a PO or tweaks a shipment status, it reflects everywhere. No guessing games. Also check if it plays nice with your accounting tools. Integration isn’t just a nice-to-have. It’s survival.

- Accuracy and Transparency

This one’s a trust thing. Imagine telling a vendor their invoice is wrong but not being able to show why. That’s when relationships crack. A good invoice reconciliation software shows exactly where things went sideways. Quantity off. Price doesn’t match. Tax code’s weird.

Whatever it is, you need full visibility.

There should be logs. Audit trails. Maybe even screenshots of the invoice scan versus PO data. You’re not just fixing issues. You’re backing up every decision with receipts.

- Data Insights

Why is vendor A always delayed? Why are freight charges rising in one region? Who’s overbilling every quarter? You need invoice reconciliation software that shows you that.

Not just totals and graphs. Real breakdowns. Insights you can act on. If it gives you dashboards that help tweak payment terms or renegotiate contracts, that’s gold. Extra win if you can export raw data and play with it deeper.

End of the day, you want invoice reconciliation software that makes you feel in control. Even when everything else in the supply chain is spinning.

- Customizable Workflows

Every company’s process is a little weird. Some have two approvals. Others need four. Some flag international shipments. Others don’t. So if your software forces you into one fixed process, that’s already a problem.

Look for invoice reconciliation software that lets you tweak flows. You should be able to build if-then rules without writing code, such as “If the invoice amount is over X, send it to the finance head.”

The goal here is less back-and-forth. The software should work like your team already works.

Benefits of Choosing the Right Software:

Choosing the right invoice reconciliation software isn’t about ticking features off a sales deck. It’s about what actually shifts when you plug it into your workflow. When the right tool’s in place, you feel it fast.

While there are endless benefits in terms of efficiency when compared to manual software, there are main ones, considering the time saved by using software.

- Faster Invoice Processing: Speed is the first thing that changes. With the right invoice reconciliation software, approvals don’t get stuck in loops. Invoices get auto-matched, flagged if needed, and pushed through without ten people touching it. This means quicker payments and less fire-fighting at month-end.

- Reduced Errors and Disputes: Manual errors tank credibility. Wrong amounts. Missed credits. Duplicate entries. They all create tension. The right software brings accuracy by default. It checks data across sources. And when there’s a mismatch, it tells you why. So disputes go down, and when they do happen, they’re easy to resolve.

- Cost Savings Through Accurate Invoice Matching and Payment Optimization: Mismatches cost money. So do late payments. So does paying for stuff you never received. Solid invoice reconciliation software helps you catch these in real time. It also makes early payment discounts easier to capture. It gives finance the visibility to avoid accidental overpayments. Small savings add up, especially at scale.

Companies like Mission Pharma saw a 20–30% improvement in internal process efficiency and lower freight costs after switching to GoComet. Their logistics head even highlighted how predictive visibility now improves customer communication.

All in all, when the software is doing the actual work, not just sitting there, you free up time, clean up data, and stop leaking money through the cracks.

That’s what good invoice reconciliation software should deliver without you babysitting it.

Examples of Softwares

Not all invoice reconciliation software is built the same. Some are general AP tools with light-matching features.

Others are purpose-built for complex logistics or procurement-heavy use cases.

Here’s a quick breakdown of some options out there:

| Software | Known For | Ideal For | Standout Feature |

| GoComet | Deep logistics + freight invoice reconciliation | Supply chain and logistics-heavy orgs | Real-time freight invoice matching with TMS/ERP |

| Tipalti | End-to-end AP automation | Global vendor payments + finance teams | Strong multi-entity and tax compliance features |

| Stampli | Collaboration-focused invoice approvals | Teams with complex invoice approval chains | Chat-style invoice collaboration inside the app |

| AvidXchange | Focus on mid-market AP automation | Construction, real estate, services | Built-in payment automation and vendor network |

| SAP Concur Invoice | Enterprise-level invoice management | Large companies already using SAP stack | Seamless SAP integration and audit trails |

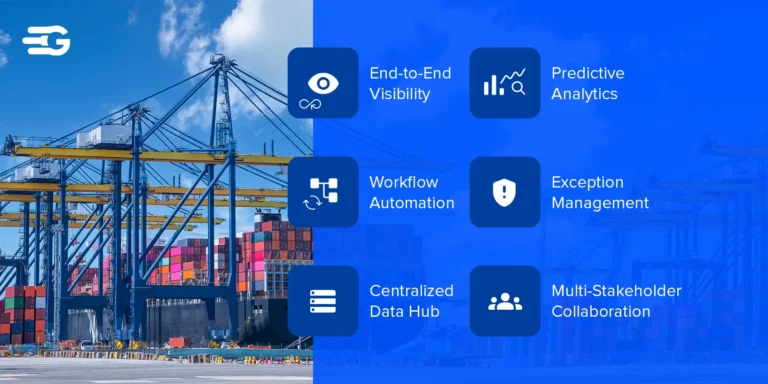

How GoComet Stands Out

Most invoice reconciliation software treats logistics like an afterthought. GoComet flips that. It’s designed for procurement and supply chain teams dealing with freight complexity, fluctuating charges, and nonstop vendor coordination. It pulls in real-time data from your TMS, ERP, and contracts to cut down mismatches, automate approvals, and give finance the context they usually chase over email.

If your current setup still involves back-and-forths, manual checks, or guesswork, it’s probably time to see how GoComet does it differently. Book a quick demo and see how much smoother reconciliation can actually be.