Brexit: Impact on logistics and the way forward

It’s been a little over one month since the much anticipated Brexit went into full effect, and shippers across the UK and Europe have been experiencing an avalanche of delays and documentation.

Businesses in the UK and organisations trading with the region are looking for ways to mitigate risks as the realities of Brexit have begun to hit home.

Is it really that big a deal?

Yes, it is. A Gartner survey found that 69% of European and 42% of North American risk, audit and compliance leaders say that Brexit uncertainty or conditions could have a moderate, significant or worse effect on their company’s revenue.

Facilitating a smooth flow of goods has been a critical function of the European Union. It has brought together countries to form an economy that offers massive economies of scale and scope. Thanks to the European free trade zone, companies in the region have enjoyed just-in-time logistics systems for all these years.

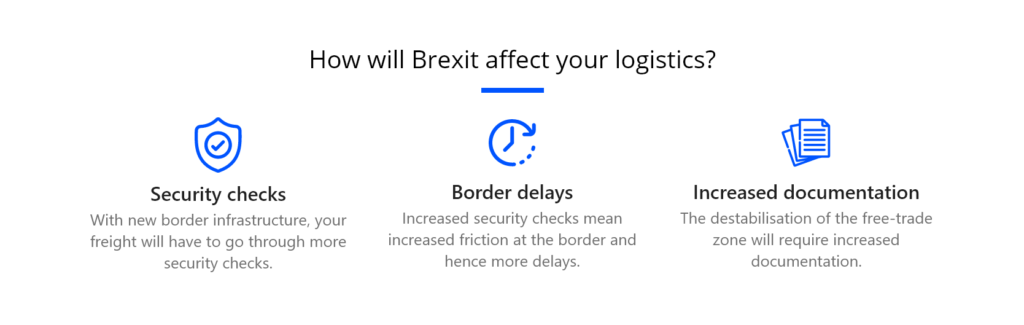

But with the destabilisation of the free trade zone, the equation changes.

What has changed and what’s expected to change?

The separation of the two regions naturally means more restrictions on goods and people’s movement than in recent memory. All of this also means increased confusion and delays in operations for enterprises on both sides of the table.

For instance, the European transportation industry’s backbone – the small and medium-sized carriers are facing the difficult challenge of meeting high customer demands amid taller barriers and new costs. Despite the uncertainty, one thing remains clear— the way companies carry out business in the UK and across Europe is set to change.

The EU is the UK’s largest trading partner and accounts for approximately half of both imports and exports of goods.

Besides, a significant proportion of the UK’s imports from and exports to the EU are in the form of intermediary products. This alone illustrates the extent of interconnectedness between the supply chains of the two regions.

With bare minimum custom regulations, businesses had it relatively easy before Brexit. A bill of lading or basic shipping related documents were enough for shippers to get their goods across the border. But now, companies are left with no option but to engage with the complexities of foreign commerce. Add this to the fact that the policy was rolled out amid a pandemic, and the severity of the situation becomes even more apparent.

A quick overview of what has changed:

- Customs Clearance – All imported and exported goods will require customs clearance at both origin and destination.

- Country of Origin – Commercial invoices need to state the Country of Origin.

- EORI Number – Some companies may have to apply for an EORI Number.

- Commodity Codes – Companies need to become familiar with customs commodity codes for imported or exported goods.

- Inventory Levels – Companies may want to consider increasing their inventory levels in the short term to de-risk in the event of shipment delays.

- Fiscal Representative – Non-resident traders who import and export will need to apply as a Fiscal Representative.

- Duty and Taxes – Government Duty and taxes will be payable on a cash upfront or deferred basis.

With all these complexities emerging one after the other, shippers across industries are experiencing a desperate need for visibility. Systems offering real-time shipment visibility have been around for a while. But these developments have accelerated their adoption.

Today shippers are investing in solutions that not only provide real-time visibility but also equip them to address problems proactively.

Acceleration of digital initiatives

For the longest time, companies’ plans to digitise supply chains lacked a sense of urgency. However, the impact of the ongoing pandemic and Brexit have compelled companies to embrace digitalisation.

These events have yet again highlighted the need for organisations to invest in better technology and optimise operations. In a nutshell, the supply chain industry isn’t dormant anymore; it’s looking for ways to thrive amid disruptions.

Technology is the new bridge

While global politics might be building more walls than bridges, technology has become a critical connector. It is gradually transforming the industry.

For instance, earlier shippers awarded business to vendors offering the cheapest rates. However, with present-day challenges, shippers are willing to look beyond the ‘cheaper, the better’ mindset. Companies are developing a more collaborative approach and are willing to pay more in exchange for facilities such as tracking, forecasting, analytics, and other tech-capabilities.

The transition from vendors and carriers scrambling to offer the lowest possible prices to providing value-added services is noteworthy. And then we have the emergence of Transportation Management Systems (TMS) which is further raising the bar for vendors and carriers. Companies are rapidly looking to adopt digitally powered control towers that reinforce real-time data visibility.

Only time will tell if the technology-first and collaborative approach will be enough to subdue the challenges posed by ongoing disruptions. In any case, be it post-Brexit or post-covid, companies have nothing to lose and everything to gain by fine-tuning strategies and embracing the right technological solutions.

For help with building a cost-effective and resilient supply chain post-Brexit, reach out to GoComet.