Quarterly carrier performance report: Identify the best carrier for your commercial routes

In today’s interconnected world, efficient shipping plays a vital role in the global supply chain. For businesses and individuals alike, finding the right carrier with reliable sailing schedules and delivery times can make all the difference.

In this blog, we will delve into the performance of various top carriers for the major routes, based on their quarterly transit time and reliability performance to help you make informed decisions when navigating critical goods.

South East Asia

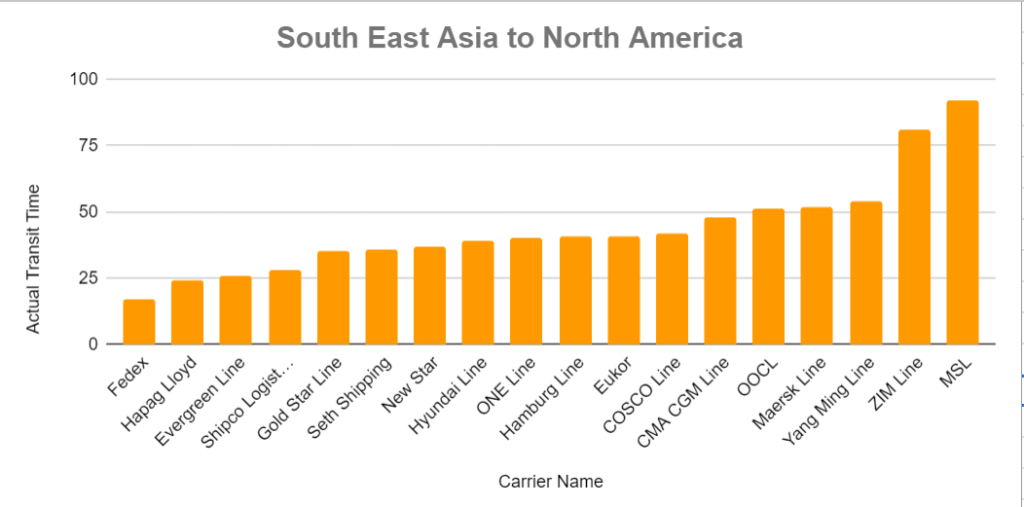

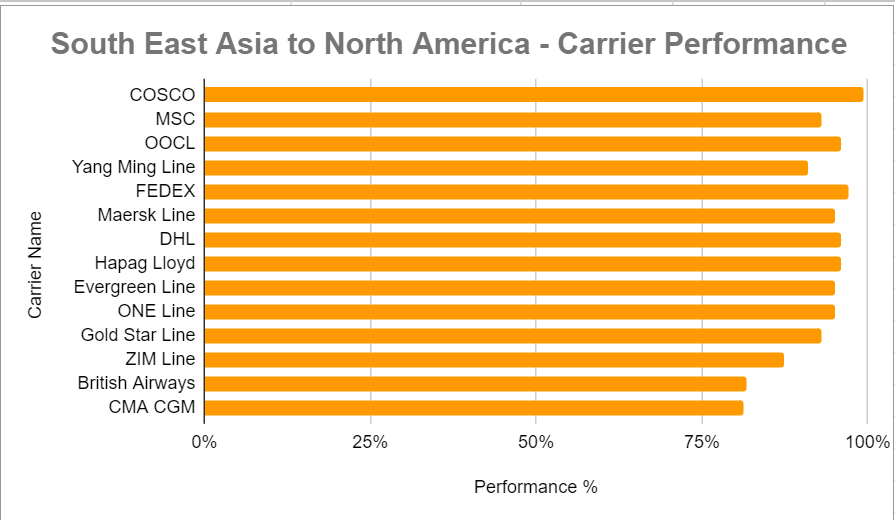

During 2023 Q2, transit durations between South East Asia and North America varied, with some carriers maintaining consistent schedules while others faced delays, including MSC and another carrier experiencing significant delays. Overall performance averaged 85%, ranging from 98% to 78%. Similar variations occurred on the SEA to Europe route, with overall performance at 93%, ranging from 93% to 76%. In the same quarter, MSC showcased reliable transit averaging 18 days, and most carriers operated efficiently, except for Pacific International Line and COSCO Line, which had average delays of 56 days. Australian National Line demonstrated consistent performance in 22 days, and other companies like Hapag Lloyd Line and COSCO Line faced delays of 50 days.

The graphical representations below show the performance of carriers on the major routes from SEA over the last 30 days.

South East Asia to North America

South East Asia to Europe

South East Asia to Middle East

South East Asia to ANZ

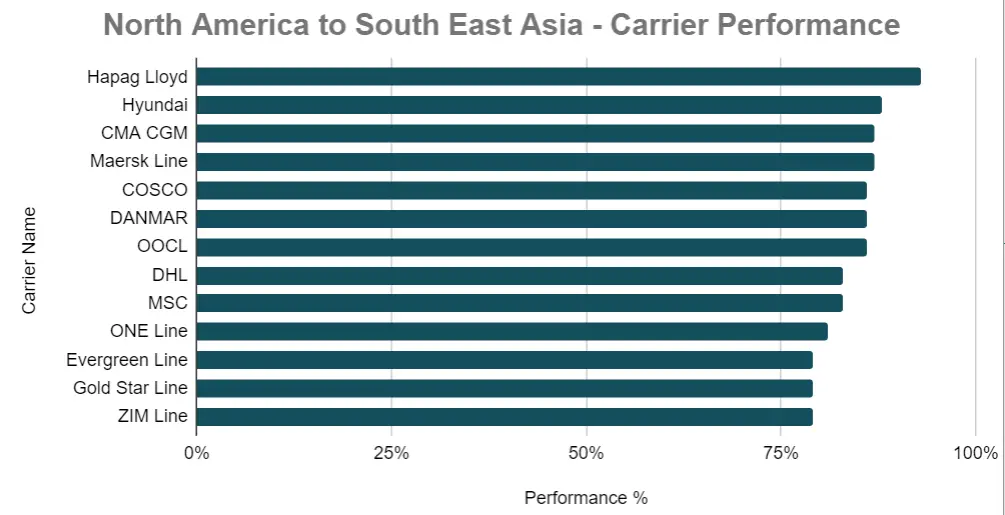

North America

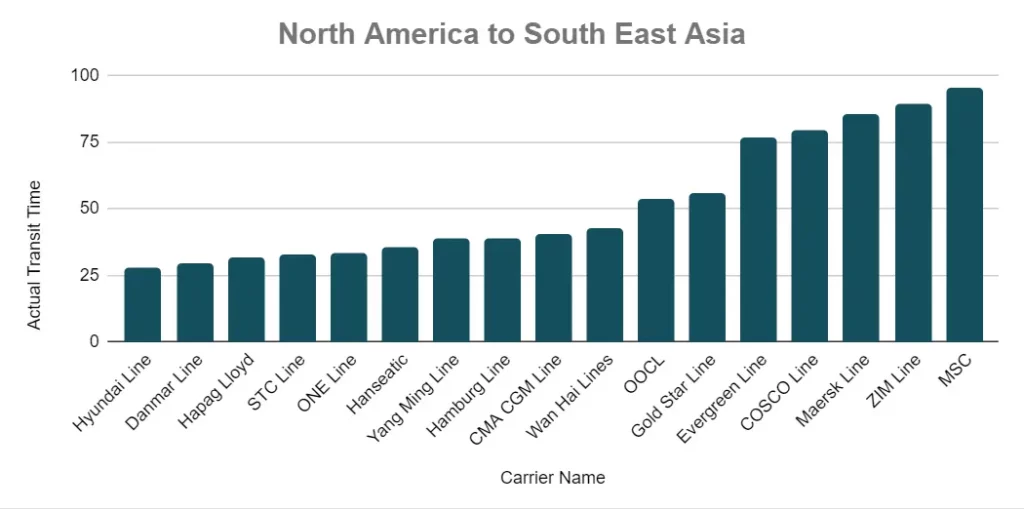

Throughout the second quarter of 2023, transit times between North America and South East Asia displayed fluctuations. Some shipping companies adhered to consistent schedules, while others encountered setbacks. Notably, carriers such as MSC, COSCO, and others experienced noteworthy delays. The overall performance metric averaged at 83%, with a range spanning from 88% to 78%. Akin variations were observed along the North America to Europe route. Here, the collective performance stood at 93%, with individual carriers performing between 93% and 79%. In that same quarter, carriers like OOCL, KLM, and ZIM line demonstrated dependable transit times, contributing to operational efficiency.

The graphical representations below show the performance of carriers on the major routes from North America over the last 30 days.

North America to South East Asia

North America to Europe

North America to Middle East

North America to ANZ

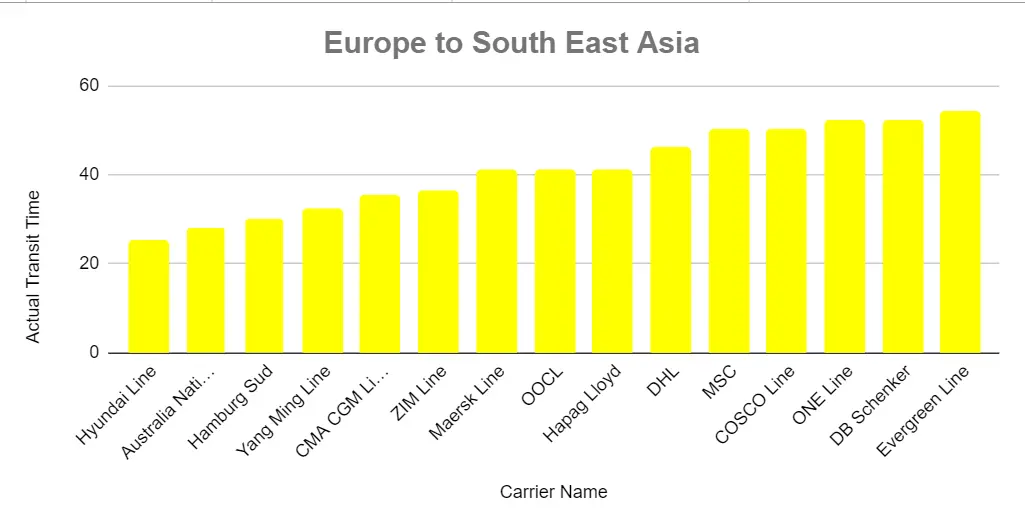

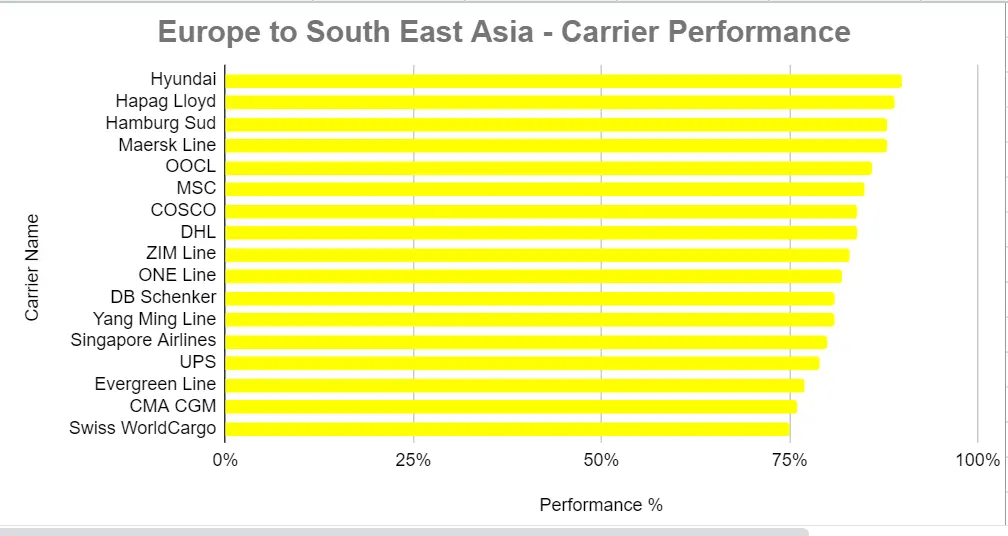

Europe

In 2023 Q2, Hyundai, Australia National, and Hamburg made a significant impact on the Europe to South East Asia route, boasting performance reliability that spanned from 76% to 88%. This trend was mirrored on the North America route, with most carriers recording an average transit time of 27 days—though MSC stood out as an exception. Noteworthy carriers like OOCL, Qatar Airways, and Maersk demonstrated impressive results on this route.

The graphical representations below show the performance of carriers on the major routes from Europe over the last 30 days.

Europe to South East Asia

Europe to North America

Europe to Middle East

Europe to ANZ

Key takeaways for major regions

US Region:

Our comprehensive analysis of major carriers, such as FedEx, OOCL, Evergreen, and MSC, underscores their performance. Notably, FedEx achieves an exceptional 95% on-time delivery rate for domestic shipments within the US, ensuring prompt receipt of critical goods. Moreover, carriers like OOCL, Evergreen, and MSC play pivotal roles, contributing to efficient solutions for time-sensitive shipments. This diverse landscape is crucial for maintaining the flow of goods across the nation.

SEA Region:

The Southeast Asian region’s bustling trade requires carriers with well-coordinated schedules and speedy delivery options. Our analysis encompassed prominent carriers, including Maersk Line, COSCO Shipping, and Evergreen Line. Maersk Line, the world’s largest container shipping company, covers approximately 76 ports in the SEA region, offering a wide network for critical goods transportation. With a robust fleet size of over 500 vessels, COSCO Shipping ensures consistent shipping services for SEA destinations. Evergreen Line, on the other hand, demonstrates an impressive average vessel schedule reliability of 89% in the SEA region, ensuring your critical goods arrive on time.

Europe Region:

Our thorough assessment of key carriers, including OOCL, CMA CGM, Maersk, Fedex and Hapag-Lloyd, reveals insights into their performance. Notably, most of the carriers stand out with an average 88% on-time delivery rate for shipments within Europe, ensuring the timely arrival of vital merchandise.

ANZ Region:

In the ANZ (Australia-New Zealand) region, the importance of efficient ocean shipment delivery cannot be underestimated, given its impact on meeting customer demands and maintaining operational excellence. Our comprehensive evaluation of major carriers, including FedEx, ANL, Maersk, COSCO and MSC, sheds light on their performance dynamics. Notably, most of the carriers stand out by achieving an impressive 89% on-time delivery rate for shipments within the ANZ region, ensuring the prompt receipt of critical goods.

Conclusion

Selecting the right carrier can significantly impact the success of shipping critical goods. Our comprehensive sailing schedule report has analyzed the performance of top carriers in the US, Europe, and SEA regions, offering valuable insights for businesses and individuals seeking reliable shipping solutions.

By leveraging our comprehensive report, you can make informed decisions and ensure the seamless navigation of critical goods to their intended destinations. Efficient shipping is the backbone of global trade, and finding the right carrier will undoubtedly contribute to the success of your business operations.

Want to know the best carrier for your next shipment? Get the live performance data