Navigating Shipping Costs from India to Canada: Your Ultimate Guide

Shipping goods from India to Canada involves understanding various factors that influence costs, transit times, and the selection of appropriate shipping methods. This comprehensive guide provides insights into shipping costs, key factors affecting these costs, main shipping methods, import taxes and duties, and tools to simplify your shipping process.

Shipping Costs from India to Canada

Improve this section. Provide insights, more details, and accurate information. Ensure the content is straight-forward, detailed, and on-point keeping in mind the search intent, readability, and writing guidelines.

Sea and Ocean Freight Rate Index

Ocean freight is the most cost-effective method for bulk shipments, though transit times are longer. Costs fluctuate based on container availability, fuel prices, demand, and specific shipping routes.

🔹 Major Sea Freight Routes:

- Mumbai to Vancouver: 30-40 days

- Chennai to Montreal: 35-45 days

- Mundra to Halifax: 25-35 days

Air Freight and Express Shipping Costs

Air freight is ideal for businesses shipping urgent, high-value, or lightweight cargo. Costs depend on cargo weight, volume, and urgency.

| Shipping Method | Estimated Cost | Transit Time | Best For |

| Standard Air Freight | $4 – $8 USD per kg | 3-7 days | Medium-sized cargo needing faster delivery |

| Express Shipping (DHL, FedEx, UPS) | $10 – $20 USD per kg | 2-4 days | Urgent and small shipments |

📌 Example Express Shipping Costs:

| Carrier | Weight | Estimated Cost |

| DHL Express | 5 kg | INR 5,000 – INR 7,000 |

| FedEx Intl. Priority | 10 kg | INR 12,000 – INR 15,000 |

| UPS Worldwide Expedited | 15 kg | INR 18,000 – INR 22,000 |

🔹 When to Choose Air Freight? If your shipment weighs over 250 kg, it may be more cost-effective to ship via ocean freight instead.

Key Factors Affecting Shipping Costs from India to Canada

Several factors influence shipping costs:

- Weight and Dimensions: Heavier and bulkier shipments incur higher costs.

- Shipping Method: Air freight is more expensive than ocean freight due to faster transit times.

- Distance and Route: Direct routes are typically more cost-effective. The distance between the origin and destination ports/airports affects fuel consumption and, consequently, the cost.

- Customs Duties and Taxes: Import duties, Goods and Services Tax (GST), and other fees imposed by Canadian customs add to the total cost.

- Insurance: Protecting goods against potential damage or loss adds to shipping expenses.

- Seasonal Demand: Peak seasons can lead to increased rates due to higher demand for shipping services.

Main Shipping Methods from India to Canada

Choosing the right shipping method depends on factors like budget, delivery timeline, and nature of goods.

Air Freight from India to Canada

- Ideal For: Urgent and high-value shipments.

- Transit Time: Approximately 3 to 7 days.

- Considerations: Higher costs; suitable for electronics, perishables, and time-sensitive goods.

Ocean Freight from India to Canada

- Ideal For: Large, bulky, and less time-sensitive shipments.

- Transit Time: Typically 25 to 40 days, depending on the specific ports and routes.

- Considerations: More economical; suitable for furniture, machinery, and large quantities of goods.

Key Ports in India and Canada

Understanding major ports can aid in planning and cost estimation.

India:

- Port of Mumbai (Nhava Sheva): One of the largest ports, handling a significant portion of India’s container traffic.

- Port of Chennai: Major port on the eastern coast, facilitating trade with North America.

- Port of Mundra: A private port known for its modern facilities and significant cargo throughput.

Canada:

- Port of Vancouver: Canada’s largest port, handling diverse cargo with extensive global connections.

- Port of Montreal: Key port on the east coast, serving as a hub for transatlantic trade.

- Port of Halifax: Strategically located for North Atlantic trade routes.

Understanding Port Selection for Cost Efficiency

Selecting the right ports affects both shipping costs and transit times. Key factors to consider include:

- Proximity to Origin and Destination: Closer ports reduce inland transportation costs, making shipments more cost-effective.

- Port Handling Charges: Fees vary between ports and can impact overall expenses. Checking these costs in advance helps in budgeting.

- Shipping Line Services: The availability of direct routes minimizes transit times and lowers costs by reducing the need for transshipment.

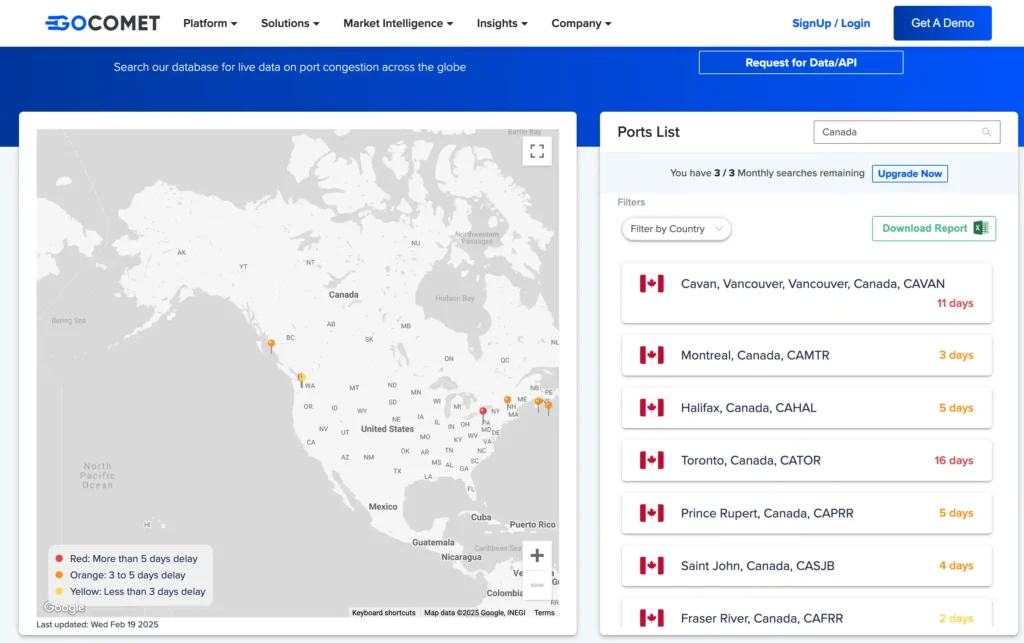

Monitoring port congestion is also crucial, as delays can lead to unexpected expenses. Tools like the Live Worldwide Port Congestion Database provide real-time congestion data, helping businesses choose ports that offer both cost efficiency and faster clearance times.

Import Tax and Duties

Understanding import taxes and duties is vital when estimating the total cost of shipping goods. Proper knowledge helps avoid unexpected fees and ensures smooth customs clearance.

Key Factors Influencing Import Taxes and Duties

Several factors contribute to the calculation of import taxes and duties:

- Classification of Goods: The Harmonized System (HS) code is used to classify goods for duty purposes. Each product has a specific code that determines the applicable tax rate.

- Value of Goods: Duties and taxes are typically calculated based on the commercial value of the goods, including shipping charges and insurance.

- Country of Origin: Trade agreements and tariffs between the origin country (China) and the destination country (UK) can influence duty rates. For example, goods from countries with trade agreements might receive lower duties.

Example of Duty Calculation

Here’s an example to better understand how import duties and taxes are calculated:

| Description | Amount (CAD) |

| Value of Goods | 10,000 |

| Duty Rate for Clothing (16-18%) | 1,600 – 1,800 |

| Goods and Services Tax (GST) | 5% of (Goods + Duty) |

| GST | 580 – 590 |

| Total Import Cost | 12,180 – 12,390 |

Note:

- The duty rate for clothing generally ranges from 16% to 18% depending on the exact classification of the garments.

- GST (Goods and Services Tax) is 5% on the total value of the goods and duties combined.

Important Note: The rates mentioned are indicative. For exact figures, consult the Canada Border Services Agency (CBSA) or a customs broker. They can provide tailored guidance and ensure accurate calculations based on your specific product.

Tools to Simplify Duty Calculations

Accurately estimating duties and taxes is crucial for cost planning. These online tools can help streamline the process:

CBSA Duty and Taxes Estimator

The Canada Border Services Agency (CBSA) tool helps estimate import duties and taxes for personal shipments based on product classification and value.

Features:

- Provides estimates for duties and taxes.

- User-friendly interface for personal imports.

Easyship Duty Calculator

Easyship’s calculator helps businesses estimate import costs, including duties, taxes, and shipping fees, by inputting shipment details.

Features:

- Estimates landed cost for global shipments.

- Integrates with e-commerce platforms for seamless calculations.

Using these tools can simplify duty calculations and help businesses plan better.

Express Shipping from India to Canada

For time-critical shipments, express shipping is a viable option.

- Major Providers: DHL, FedEx, UPS, and Atlantic International Express.

- Services Offered: Door-to-door delivery with customs clearance support.

- Transit Time: Typically 2 to 5 business days.

- Cost Considerations: Higher rates compared to standard air freight; suitable for small parcels and urgent documents.

Example:

- Atlantic International Express: Offers services starting from INR 450 for documents.

.

Shipping Cost Calculator: Picking the Best Method

To determine the most cost-effective shipping method:

- Assess Shipment Details: Evaluate weight, dimensions, and nature of goods.

- Compare Rates: Use shipping calculators provided by carriers like UPS

- Factor in Duties and Taxes: Include customs fees to get the full cost picture.

- Consider Delivery Time: If speed is crucial, opt for air or express shipping.

- Use Freight Platforms: Services like GoComet’s Freight Calculator help compare real-time freight rates and select the best option.

FAQs

How Long Does Sea Freight Take from India to Canada?

Transit time depends on the shipping route and port selection. On average:

- From Mumbai to Vancouver: 30 to 40 days

- From Chennai to Montreal: 35 to 45 days

- From Mundra to Halifax: 25 to 35 days

Delays may occur due to port congestion, customs clearance, or weather conditions.

How Much Does a Shipping Container from India to Canada Cost?

The cost of shipping a 20-foot container from India to Canada ranges from $2,500 to $4,000 USD, while a 40-foot container costs between $4,500 and $7,000 USD. These rates depend on cargo type, demand, and fuel surcharges.

How Much Does LCL from India to Canada Cost?

Less than Container Load (LCL) shipping rates are based on cubic meters. Rates typically range from $25 to $60 USD per cubic meter, depending on the route and carrier.

What are the Best Sea Freight Companies in India?

Top shipping companies offering services from India to Canada include:

- Maersk Line – Global shipping giant with extensive routes.

- MSC (Mediterranean Shipping Company) – One of the largest container shipping operators.

- CMA CGM – Reliable service with competitive rates.

- COSCO Shipping – Strong global presence and frequent sailings.

How to Ship from India to Canada?

Follow these steps:

- Choose a Shipping Method: Decide between air, ocean, or express shipping.

- Get a Quote: Compare rates from freight forwarders or online calculators.

- Prepare Documentation: Ensure you have a bill of lading, commercial invoice, packing list, and import/export permits.

- Arrange Customs Clearance: Work with a broker to handle duties and taxes.

- Track Shipment: Use tracking tools provided by carriers or freight platforms.

Optimize Your Shipping Costs with GoComet’s Freight Calculator

Save time and money on your shipments from India to Canada. GoComet’s Freight Calculator lets you compare real-time freight rates, helping you pick the best shipping option.

👉 Get Instant Freight Quotes Now